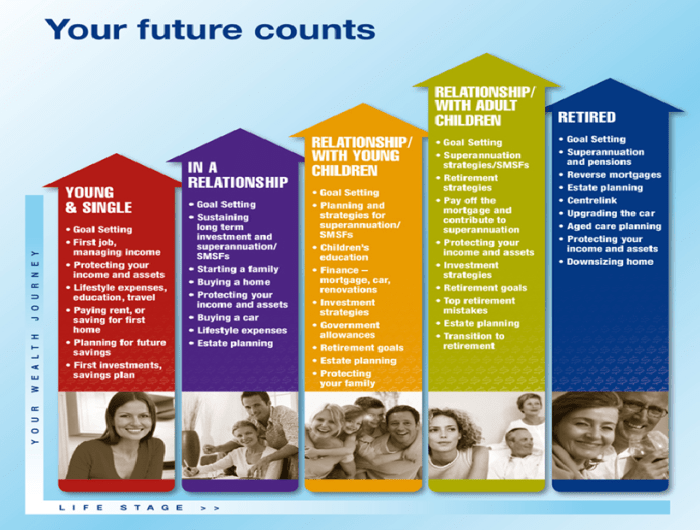

Embark on a financial journey through life’s stages with our comprehensive guide, the financial stages of life everfi answers. This insightful exploration unravels the intricacies of each phase, empowering you with the knowledge to make informed decisions and achieve financial well-being.

From the challenges of early adulthood to the complexities of retirement, we delve into the key financial milestones, responsibilities, and opportunities that shape our financial lives. Whether you’re just starting out or preparing for the future, this guide provides invaluable insights to help you navigate every step of the way.

Financial Stages of Life: The Financial Stages Of Life Everfi Answers

Individuals navigate various financial stages throughout their lifetime, each presenting unique challenges and opportunities. Understanding these stages and the associated financial responsibilities is crucial for effective financial planning and securing financial well-being.

Early Adulthood

- Financial challenges: Student loans, starting a career, establishing a household

- Tips for effective financial management: Create a budget, prioritize essential expenses, explore income-generating opportunities

- Importance of saving for the future and investing in retirement: Establish a retirement savings plan, take advantage of employer-sponsored retirement accounts

Midlife, The financial stages of life everfi answers

- Financial responsibilities and goals: Raising a family, paying for college, saving for retirement

- Strategies for managing multiple financial obligations: Prioritize expenses, explore additional income streams, consider refinancing options

- Importance of estate planning and preparing for future financial needs: Create a will, consider life insurance, plan for long-term care expenses

Retirement

- Financial challenges and opportunities: Managing retirement income, healthcare costs, leisure expenses

- Tips for planning a secure retirement: Plan early, diversify investments, explore part-time work or consulting opportunities

- Importance of staying financially active and engaged in retirement: Maintain social connections, pursue hobbies, explore volunteer opportunities

FAQ Resource

What are the key financial challenges faced by young adults?

Young adults often face challenges such as student loan debt, establishing a career, and starting a household, which can strain their finances.

How can I effectively manage my finances during midlife?

Midlife brings increased financial responsibilities, such as raising a family and saving for retirement. Creating a budget, prioritizing expenses, and seeking professional advice can help manage these obligations.

What are the financial implications of retirement?

Retirement involves managing retirement income, healthcare costs, and leisure expenses. Planning ahead, investing wisely, and staying financially active can ensure a secure and fulfilling retirement.