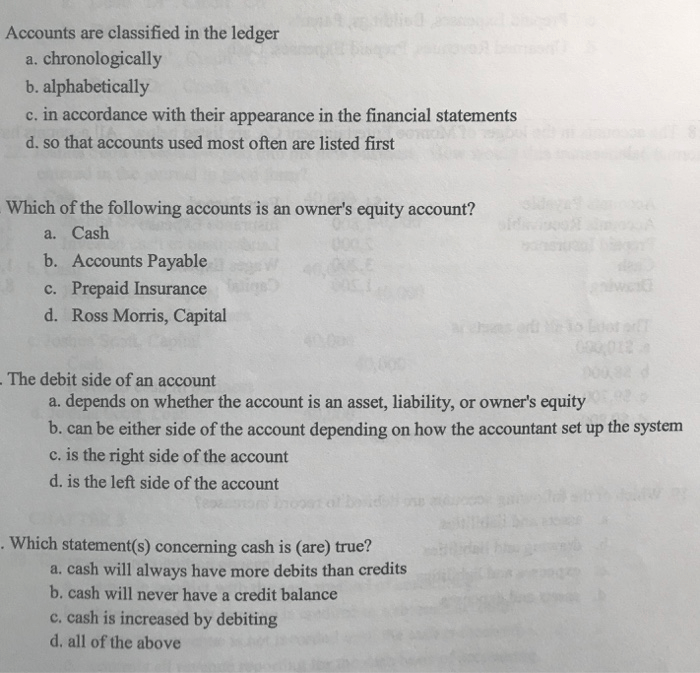

Accounts are classified in the ledger, forming the cornerstone of financial reporting and accounting practices. This intricate system of categorization serves as the foundation for recording, tracking, and analyzing financial transactions, providing invaluable insights into the financial health of an organization.

The classification of accounts is not merely an arbitrary exercise; it is a structured approach that ensures accuracy, consistency, and comparability in financial reporting. By adhering to established criteria, accountants can ensure that financial statements are presented in a manner that is both informative and reliable.

Classification of Accounts in the Ledger

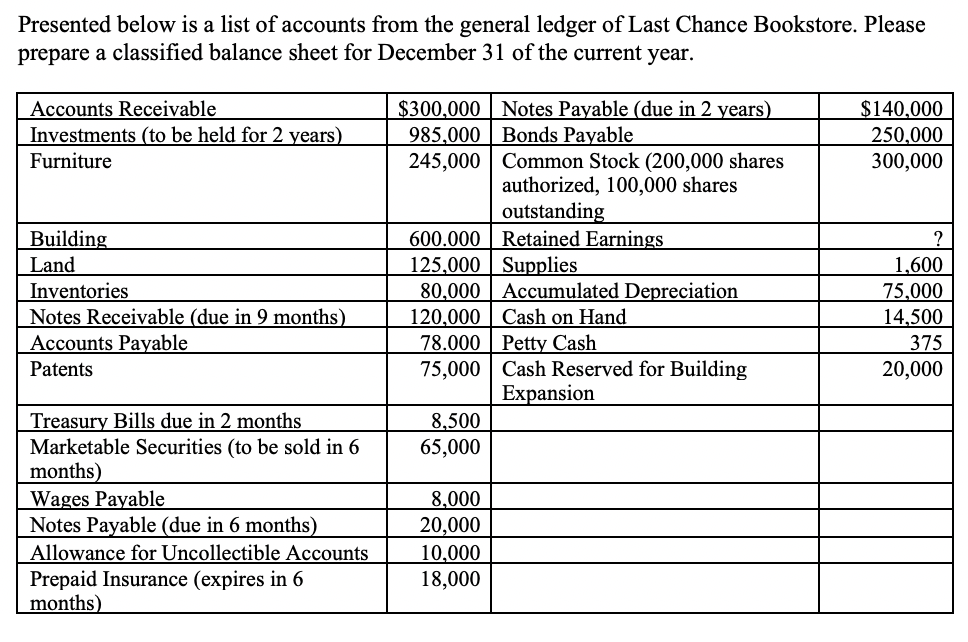

The ledger is a financial record that organizes and summarizes all financial transactions of an organization. Accounts are classified in the ledger to facilitate the recording, tracking, and reporting of these transactions. The classification of accounts is based on their nature and function in the accounting system.

The following are the main types of accounts that can be classified in a ledger:

- Assets:Represent the resources owned by an organization, such as cash, accounts receivable, inventory, and equipment.

- Liabilities:Represent the debts owed by an organization, such as accounts payable, loans, and taxes payable.

- Equity:Represents the ownership interest in an organization, including capital stock, retained earnings, and other equity accounts.

- Revenue:Represents the income earned by an organization from its operations, such as sales of goods or services.

- Expense:Represents the costs incurred by an organization in generating revenue, such as salaries, rent, and utilities.

The criteria used to classify accounts include:

- Liquidity:The ease with which an account can be converted into cash.

- Permanence:The length of time an account is expected to exist.

- Function:The role an account plays in the accounting system, such as recording revenue, expenses, or assets.

The classification of accounts is significant for financial reporting because it provides a structured framework for organizing and presenting financial information. This allows users of financial statements to easily understand the financial position and performance of an organization.

Top FAQs: Accounts Are Classified In The Ledger

What are the main types of accounts classified in the ledger?

The main types of accounts classified in the ledger include assets, liabilities, equity, revenue, and expenses.

What criteria are used to classify accounts in the ledger?

Accounts are classified in the ledger based on their nature, function, and relationship to the accounting equation.

What is the significance of account classification in financial reporting?

Account classification is significant in financial reporting as it provides a structured framework for organizing and presenting financial information, enhancing its clarity and comparability.